Why Businesses Should Adopt Blockchain Accounting in 2025

Written by

Nabia Hassan Sabzwari

Last Updated: May 30, 2025

Your Blockchain Journey Starts Here

Whether you're launching a DeFi platform, NFT marketplace or enterprise blockchain solution, we deliver technology that transforms. Book Your Free Consultation Today.

Modern business requires full transparency and sharing information with employees to prompt a transformative shift in culture. It helps build trust with stakeholders, and is crucial to guide business decisions.

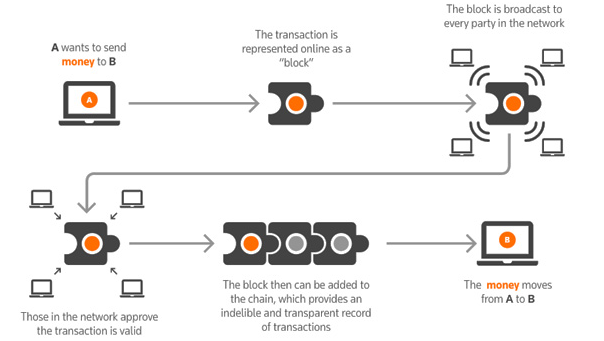

Financial security is equally important to prevent data loss through leaks or online threats. Blockchain can digitize the entire finance trade and record keeping with both of these intrinsic characteristics: transparency and security.

Blockchain accounting comes into play when manual record keeping is extensive and third-party interference can be risky. So in this case, custom blockchain accounting development provides businesses with more control and customization to tailor specific needs but is costly.

In this article, we’ll discuss the need for blockchain in accounting, key features of blockchain accounting solutions, related case studies and how to develop custom blockchain accounting software.

The need for blockchain in accounting

In 2001, the Enron scandal manipulated financial records to hide debt, marking the largest corporate fraud in history. Centralized databases often represent single points of failure. A malicious insider or external attacker gaining the right access level can modify, overwrite or delete records which could conceal fraudulent activities for long periods.

When blockchain steps in, several benefits remove these risks from the equation.

1. Immutability

Blockchain’s immutability makes it nearly impossible to tamper with records. Each block is cryptographically linked to the previous one. Any attempt to alter a historical entry breaks this cryptographic link, making manipulation difficult and easily detectable. This significantly improves data integrity and auditability.

2. Smart contracts

Blockchain platforms like Ethereum introduced smart contracts which are self-executing agreements that enforce contractual clauses once specified conditions are met. For accounting, smart contracts can automate compliance checks, budget approvals and other internal controls, helping to streamline processes, reduce operational costs, and improve efficiency.

3. Real-time tracking

Blockchain enables real-time transaction tracking thus eliminating manual reconciliation and minimizing inconsistencies. With real-time access to tamper-proof records, businesses can be sure of transparency and speed up audit processes. This leads to well-informed decision-making and better financial oversight.

4. Regulatory compliance

Blockchain’s transparent and unchangeable records make regulatory compliance easier by preventing illegal changes. Smart contracts reduce the risk of fraud and human error by automating compliance checks. Real-time access for regulators ensures timely adherence to financial laws.

Key features of custom blockchain accounting solutions

Custom blockchain-based accounting systems are transforming financial management by improving transparency, automation, and security. Unlike traditional systems, which rely on centralized databases and are prone to manipulation, blockchain introduces structural safeguards into every transaction.

Source: Cleardocs.com

Here are the core features businesses should look for:

1. Triple-entry accounting

Traditional accounting uses a double-entry system (one party debits, the other credits). But both entries live in separate systems. With triple-entry accounting, transactions are also recorded on a shared, immutable blockchain ledger.

This third entry acts as a cryptographically secure digital receipt accessible to all authorized parties. It reduces the risk of data manipulation, fraud, and inconsistencies while providing a clear audit trail.

For example, if Company A pays Supplier B, both keep internal records, and the blockchain stores a third, permanent one accessible to auditors.

2. Smart contract automation

These programmable contracts automate financial processes once conditions are met. They’re useful in areas like payroll, tax compliance and invoicing.

For example, a blockchain-based payroll system can release salaries automatically once work hours, tax deductions, and compliance are validated. Tax payments can be calculated and submitted without manual intervention. In logistics, payments to drivers can be triggered once delivery is confirmed, eliminating paperwork and disputes.

3. Real-time auditing

Blockchain removes the need to wait for periodic audits by making financial records available in real-time. Regulators and accountants can access verified transactions instantly, reducing the time and cost of audits.

A retail company using blockchain accounting can provide tax authorities with immediate access to VAT payments which would help reduce evasion and compliance delays.

4. Easy integration with legacy systems

For blockchain accounting to be viable, it must work with existing platforms like ERPs, banks, and accounting software.

Companies like SAP are already building blockchain solutions for automated supply chain payments. A manufacturing company, for example, can integrate blockchain into its ERP system to automate supplier payments once product deliveries are confirmed.

Case studies: businesses using blockchain accounting

Enterprises from diverse sectors are incorporating blockchain technology to improve financial management’s efficiency, security and transparency. Blockchain is revolutionizing accounting, auditing and financial settlements because it offers an unchangeable and verifiable record of transactions.

Let’s take a look at businesses that have taken a step towards decentralization.

1. PwC

PwC integrates blockchain into its auditing services to provide transparent, traceable records of financial data. The technology makes sure that all asset movements can be tracked across their lifecycle to create an immutable audit trail. Fraud is easier to detect, and audits become faster and more reliable.

2. Microsoft

Microsoft uses blockchain to manage royalty payments for digital content creators. Smart contracts automate payments which reduces the need for reconciliation and disputes. This system ensures musicians, developers, and other creators are paid fairly and promptly, improving trust in the process.

3. JPMorgan

JPMorgan uses its permissioned blockchain, Quorum, to improve financial settlements. The platform allows secure interbank transfers, reduces reliance on intermediaries and cuts operational costs. With faster transactions and better compliance visibility, Quorum enhances both efficiency and auditability.

How to develop a custom blockchain accounting software solution

Creating a blockchain accounting software for your own business involves several steps, from choosing the right network to ensuring security and compliance.

1. Choosing the right kind of blockchain

Businesses must decide between:

Public blockchains → Ideal for transparency and decentralization but may have scalability issues (e.g., Ethereum).

Private blockchains → Offer more control, speed and privacy, which are often better suited for internal accounting systems (e.g., Hyperledger, Quorum).

2. Defining the technology stack

A blockchain accounting solution, often delivered through specialized blockchain development services, requires a carefully selected technology stack. Key components include:

Blockchain platform → Choose from Ethereum, Hyperledger or Quorum, each offering different strengths for financial applications depending on transparency, privacy and transaction speed needs.

Smart contracts → To automate key operations like invoicing, payroll, compliance checks and other financial transactions. This reduces manual intervention and improves accuracy.

Databases & APIs → To integrate with ERP systems, banking platforms, and traditional accounting tools to unify operations and avoid data silos.

3. Implementing security & compliance measures

Encryption & authentication → Secure all data using cryptographic hashing and multi-factor authentication.

Access control → Assign clear permission levels to roles like accountants, auditors, and regulators.

Regulatory alignment → Ensure compliance with financial regulations like GDPR, IFRS, and SEC standards.

4. Partnering with a blockchain development company

Working with an experienced blockchain development company ensures you get a scalable, secure and compliant product. These partnerships reduce development risks, cut time to market, and enable deeper integrations with existing systems.

Conclusion

Blockchain accounting is truly changing how businesses manage their finances by offering transparency, fraud prevention and process automation. With blockchain accounting software customized to their needs, businesses can streamline operations, strengthen compliance and prepare for the future of financial reporting.

While development may seem complex, the long-term value is substantial: faster audits, lower operational costs and reduced risk.

If you're a business looking to future-proof your financial infrastructure, investing in blockchain development services like those offered by Pixelette Technologies could be the next smart step.

FAQs

1. What is blockchain accounting software? Blockchain accounting software uses distributed ledger technology to securely record financial transactions. It automates invoicing, payroll, auditing and other processes to reduce errors and fraud.

2. Which industries benefit from blockchain-based accounting? Industries like banking, logistics, real estate, healthcare and entertainment benefit from transparent and secure financial operations using blockchain accounting.

3. What are the development costs and challenges? Costs depend on your chosen blockchain, features and integrations. Challenges include regulatory complexity, scalability and hiring skilled developer teams. A blockchain development company can help mitigate these risks.

4. How does blockchain accounting improve regulatory compliance? By providing real-time, tamper-proof records, blockchain simplifies compliance audits. Smart contracts enforce financial rules automatically, reducing manual errors.